Credit Card Reader for iPhone: Smart Choices For Your Small Business

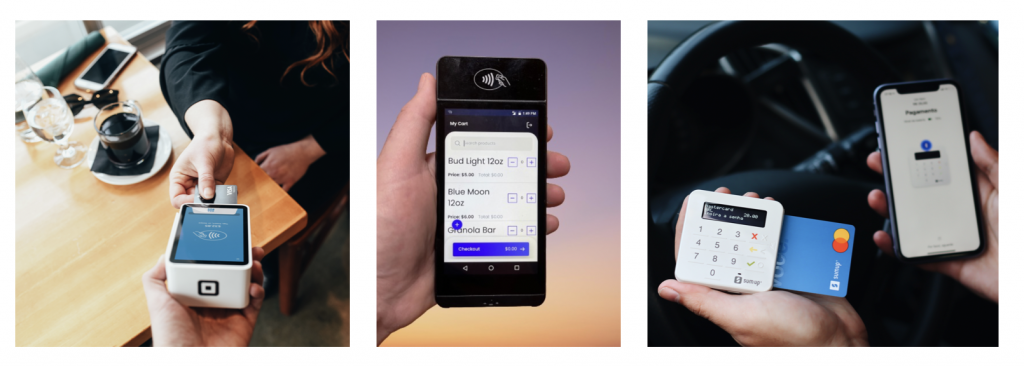

The latest crop of credit card readers for iPhone can read a card via a swipe, dip, or tap – sometimes all three. If you’re a small business owner or freelancer looking for an affordable way to take payments, chances are good that you’re comparing Square, Clover, SumUp, Zettle, and others.

Here are some questions to consider as you research:

- What functionality will help me best serve my customers? Do you need a solution that is highly customizable, in order to sell many different products? Or, do you need something that has the easiest possible user interface for your customers, so you can sail through the lunchtime rush? There is a range of products available that suit a variety of situations.

- What credit card processing fees will I pay? Every credit card transaction comes with a fee, ranging from 2.29% + 9 cents per transaction, to 2.8% + 10 cents on the high end. The card readers that are most customizable tend to be the most expensive: Clover has the highest fees at 2.7% + 10 cents per transaction.

- How will I connect to the internet? Will you be in a space with reliable WiFi when you use your device? Or will you be relying on network data? Not being able to reliably complete transactions due to internet woes can be a huge detriment to your business. Some card readers have an “offline mode” so that you can still conduct your business and connect to the internet later.

Credit Card Reader for iPhone: Pros and Cons

A credit card reader and iPhone can be a good option if you need a minimal amount of functionality for the lowest possible cost. However, there are some downsides:

- Privacy: Do you really want to use your personal smartphone or work cell as your card reader for your small business? Your phone is sacred. Banking, health info, pictures of your cat…it’s all right there on your iPhone. (Or Samsung – whatever floats your boat.)

- Cell Coverage: If you conduct your business on-the-go, you can’t guarantee a reliable internet connection. What happens if you find yourself needing to take a payment, and your phone can’t connect to wifi or data?

- Checkout Experience: If your internet connection is slow, the process of swiping your card and going through the several steps to confirm the purchase can be excruciating for your customers. Not the best way to gain their repeat business!

Alternatives to Credit Card Readers: PatronPay

If using your iPhone for credit card payments is not sounding like the best idea, you may be wondering if there is a way to have separation of church and state. Or in this case, separation of your iPhone and your credit card reader.

This unicorn does exist, and it’s called PatronPay. Smaller than the latest iPhone, PatronPay is a credit card and mobile app payment terminal that fits in your pocket. It runs on a separate data plan, so no more worrying about being caught in a space with a poor internet connection. If you don’t want to shell out for a full POS system, but you also want more functionality than just a chip reader attachment, PatronPay is for you.

Say you’re running a food truck. You don’t have the space or money for a full point of sale system, but you do need to be able to set up a menu with prices, take payments via cash and credit, print receipts, and sync with Venmo and Paypal. And you need to be able to do it fast, in order to process the dozens of customers who have lined up to try your artisanal milkshakes.

Not a food truck? PatronPay is designed to be highly customizable, yet dead simple to use. The product works for businesses, charities, freelancers and contractors, schools, community groups, and more. Here are some of the pros and cons.

| Credit Card Reader Add-on for iPhone | PatronPay |

| Awkwardly attaches to phone | Sleek, all-in-one terminal dedicated to payment processing |

| Have to hand your expensive personal property to customers and team members – could be lost | Completely separate device just for payment solutions |

| Links to various POS software of varying quality | Comes with comprehensive POS software that can be customized for a variety of situations – charity events, food trucks, sporting events, contractors working on-site, and more |

| Rarely compatible with other payment aps | Works with PayPal and Venmo |

With PatronPay, when you’re swiping a customer’s card and your phone buzzes with an incoming client call, you are not caught between a rock and a hard place. You can take the call (or check your social media, we’re not judging). It’s a great solution to handle your payment needs for a vast array of situations. Learn more at https://patronpay.us.